Bhumi Chaudhary, Investment Team Member, Astra Asset Management

Markets are difficult: but don’t be found asleep at the wheel.

The real estate sector is currently facing headwinds. Some asset classes, such as offices, are impacted much more than others, but the impact is widespread. Despite this, real estate has not and will not lose its relevance in the foreseeable future. What is likely, however, is that the form or utilisation of the ‘space’ will change over time. Advancements in technology do not diminish the need for individuals to sleep, meet and interact. The intent is to optimize and reprioritize space in order to make life easier for us.

The importance of real estate as an asset class does not require any description. Exposure to real estate is not just limited to property developers, but extends broadly to include financiers - such as banks, asset managers and private credit funds – as well as almost every investor - whether institutional or retail, directly or indirectly. In fact, for retail investors, one of the largest indicators for consumer confidence emanates from the increase in the value of their home equity.

Meanwhile, the transformation of this sector is undeniable. From the disruption of retail malls by online shopping to the zoomification of office space in the post-Covid era, much of the transformation is driven by technology. Although utilization changes, from malls to Amazon warehouse and from office to co-living, real estate remains and, some may argue, has become an even more interesting investment today than it has been for a long time. Accordingly, participants in the sector - developers as well as investors - must all carefully and consciously re-evaluate their investment strategy and avoid the trap of simply continuing down the same path they followed previously (simply because it may have worked), or risk walking obliviously into negative equity due to devaluation of the assets they are invested in.

This article provides a perspective on how participants in the sector, such as property developers, their service providers and investors, might navigate these challenging market conditions to evaluate their next course of action.

Underlying drivers of these headwinds

In order to understand how to tackle these challenges, one must first understand the underlying reasons. There are three primary causes:

1. Macro-economic environment driven by rate changes

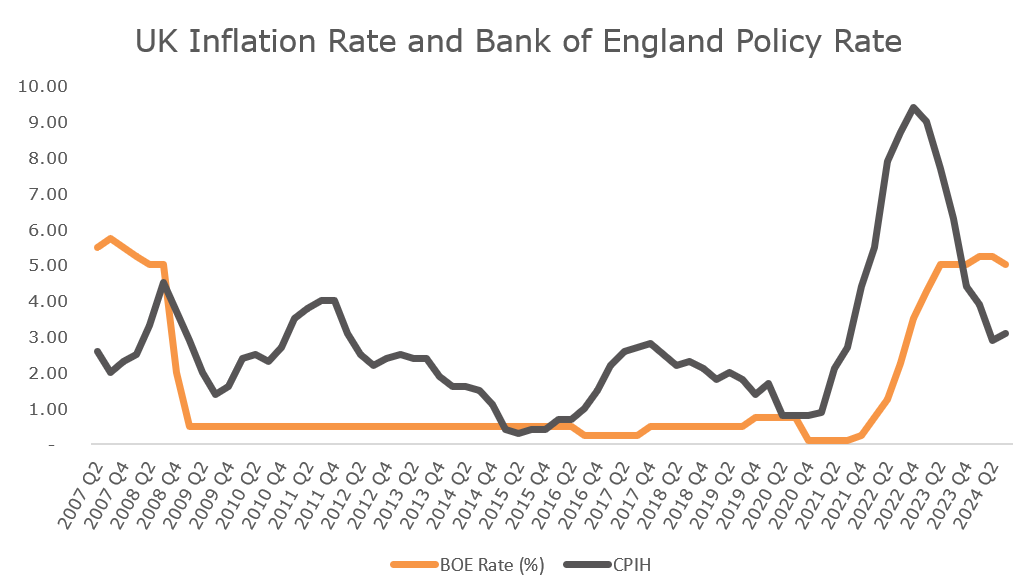

Source: ONS, Bank of England

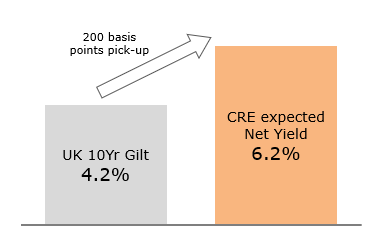

After a long spell of extremely loose monetary policy, central banks across the globe decided to raise the interest rates in rapid succession, beginning in Q4 2022. Their intention was to combat inflation that had been climbing steadily since Covid. Financing costs on mortgages for many properties have increased while the rents have been locked-in at fixed lease rates. That has not only created an imbalance between the revenue from the rental income and the cost of financing, but has also consequently resulted in a reduction in the value of the properties. since property investments are often compared to the yield investors can obtain from investing in long-term government bonds. For example, if 10 year government bonds yield 4.2% in the UK, investors would typically expect a net yield of at least 2% higher than Gilts. Price movement in commercial real estate (CRE) is therefore, driven by changes in the expectation of government bond yields.

In addition, many CRE assets are held in funds, some of which may need (or at times are forced) to sell assets to match redemptions (in the case of liquid funds) or at the end of a fund’s life. As a result, with fewer investors chasing these assets, coupled with forced sellers, the resulting demand/supply mismatch creates further downward pressure on prices. To add to these woes, many financiers are already over exposed to CRE loans that may have had to be amended or extended as they are not able to find an alternative financing. As a result, such financiers are not looking to add further risk on their existing CRE loan books. With the absence of such financing, capital allocated in the asset class has become even thinner.

A combination of reduced financing, interest rate changes and supply/demand mismatch from the investor base has therefore created significant headwinds for the asset class.

2. Broader Credit Environment

Financing institutions have in certain cases had to foreclose on real estate assets because borrowers have not been able to arrange alternative financing at maturity, for the reasons mentioned above. Increases in loss provisions due to the enhanced risk in real estate credit has widened the margin that financiers now require to provide credit, thereby increasing the cost of capital even further for property investors. Not only do financiers require a higher margin to compensate for the higher risk of default but often also reduce the maximum size of the loan in relation to the value of the asset (Loan To Value). Understandably, higher margins coupled with higher central bank rates create a double whammy for borrowers and often renders the asset insolvent in current market conditions.

3. Transformation in Real Estate consumptions

However, the largest factor that creates the most significant concern amongst financiers and real estate equity investors alike is the transformation in various real estate assets and the resulting change in demand for such assets.

There has been a sea-change in the consumption of real estate needs in past years that has led to a re-allocation of capital to more emerging asset classes. These include high end logistics, specialist warehouses, co-living, data centres and new energy. In light of these changes and general evolution in the real estate market environment, property developers also need to evolve and change their focus towards such emerging classes.

What does this mean for the developers?

In an ideal world, developers should re-evaluate the competitive landscape for their asset class. In order to identify its relevance, they must evaluate the impact of the challenges facing their asset class and make a clear-eyed determination of:

- Whether there is a continued demand for it,

- Whether that demand is sustainable, and

- The source of the demand and how likely is it to change due to innovation and advancement in technology.

This requires them to predict the future of technological changes, to exit asset classes that are likely to depreciate in value and to re-invest that capital in more suitable, emerging asset classes.

This would require a developers not only to analyse and predict technology-led disruption in the real estate market but to also then identify the right asset class and, further, obtain the credibility to invest in this new class. This is a pipe dream and the following could be a better alternative

Lean on sophisticated capital market participants to do that analysis.

Investors, including credit financing providers, carry out detailed analysis and evaluate the market conditions for all relevant real estate asset classes. In order to determine the risk in a financing transaction, credit investors look at all different aspects, including a possible migration of credit and potential change in the property prices. They also have a broader view of credit migration in different locations and, based on that data, can form a fairly detailed view about the viability of their investment. This analysis is then eventually reflected, in the form of margin and the LTV of the financing for the asset class in that geography.

Developers can therefore take guidance from this investor analysis to determine which sub-asset class to shift into as follows:

While these steps are a quick short-cut to identifying the right asset class for the target location, of course, developers can carry out the analysis themselves.

Emerging Asset Classes

Office, retail and many other traditional asset classes have consistently faced headwinds. While in some cases, simply waiting for the markets to stabilise may be the best strategy, developers should nevertheless proactively evaluate new emerging asset classes including data centres, co-living and specialist logistics. Many of these have seen significant capital chasing them. Similarly, some traditional assets have also seen better investor uptake than others. Evaluating the best fit for the target location is the key.

Living and Hotels stealing the show in the UK

2024 was not the best year for the UK real estate market as transaction volume only reached up to £24bn in first half of 2024, which reflects a decline of 7% on year-on-year basis according to an abrdn report. The biggest winner was the residential sector, which took the largest share of the pie of 23% as it offered investors strong rental value growth potential. The UK is still facing a demand and supply mismatch in housing with tougher planning regulations and higher cost of construction. Therefore this asset class still remains the focus for investors as demand for core residential and other living assets like co-living, PBSA, Student Housing is increasing every year. The hotel sector also had a platform finish in the runner-up position with an 18% share primarily driven by North American investors buying assets primarily around London. Hotel space is an asset class which was struck hard during Covid but started to recover in 2022 when Covid restrictions eased. Unlike other asset classes where rental rates are locked-in, hotels were able to pass through the inflation costs directly to end customers, increasing ADRs across all hospitality assets – and, despite experiencing low occupancy, the business model worked very well for them.

Among the laggards, office assets took the wooden spoon, as it remained the least favoured asset class, due to substantial repricing in the sector resulting from historically tight yields. However, this presents an opportunity to pick good office assets in core locations with bad balance sheet at a significant discount and generate high net total return.

Industrials and logistics attracted liquidity post-Covid due to a boom in logistics trading as tight as 3% yield. The sector went through a sharp repricing in late 2022 and appears to have returned to a stable level with the bid-offer gap diminishing.

With rapid global digitalization and AI advancement, another asset class that has been increasingly gaining in popularity among investors is data centres. They offer medium- to long-term contracted cashflows from big tenants, the likes of Meta and the Amazons of the world. Demand for data centres is accelerating while supply faces multiple challenges. The result is a strong fundamental outlook for data centre assets in the near- and-medium term. Data centres are finding financing even for green and brown field levels because investors are keen to provide capital to them.

Conclusion

Even with the changing macro environment, real estate as an asset class has shown resilient fundamentals and remains the focus for many institutional and retail investors. The key is to adapt as the industry evolves and let the availability of liquidity be your guide. You should use the comprehensive credit analysis done by the army of analysts at banks and credit shops as an indicator for which asset classes to invest in. The telltale signs of an optimal asset class include:

- The availability of high-end analysis reports for that asset class,

- Banks eager to provide finance and extend credit, and

- Lease-up is not challenging.

Disclaimer

This article has been prepared by Astra Asset Management UK Limited (Astra). Astra is authorised and regulated by the UK Financial Conduct Authority and is registered as an Investment Adviser with the US Securities Exchange Commission, solely in relation to US persons. The article comprises Astra’s opinion, it is not investment advice and does not comprise a recommendation to enter into any transaction or to follow any investment strategy. Any future-looking statements may comprise hypothetical information, and you should carefully consider the risks inherent to such information when considering this article. Astra will not accept any liability based on the article or any errors or omissions therein. You should obtain professional advice before entering into any transaction or other investment decision. Capital invested is at risk, including of total loss.